Europris

The discount varity retail king of Norway

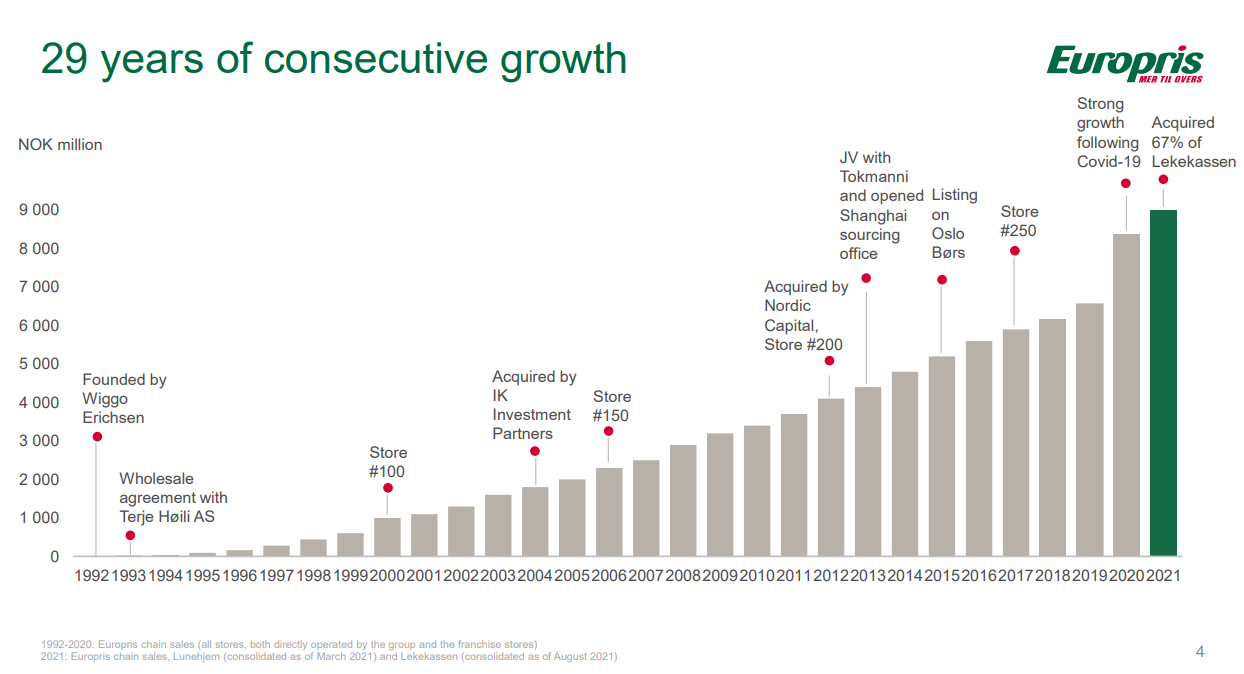

Europris (Ticker: EPR) is Norway’s largest discount variety retailer (similar to Dollar General). Currently, they have 270 stores covering all of Norway. Europris’s brand awareness is strong, and you probably will not find a person in Norway that have not heard of Europris. In 2021 Europris had 35 million customer visits which ended in revenue of NOK 8,649 billion for the full-year 2021. And since its founding in 1992, Europris has managed to have 29 years of consecutive revenue growth.

Europris was acquired by PE firm Nordic Capital in 2012 and then listed as a public company on the Oslo Stock Exchange in 2015. Since the listing, Europris has continued to grow steadily and has acquired faster-growing e-commerce businesses Lekekassen and Lunehjem.

Heavily focusing on cost control and running a lean operation, Europris has shown great execution of its strategy. Europris is currently selling products from their own stores and through some franchise stores. Europris focuses only on opening directly operated stores and franchise stores is declining every year. Franchise stores account for 10,3% of all stores as of Q4 2021.

Who is the customer?

The typical Europris customer lives outside of the major cities in Norway. Therefore, it would be fair to assume that the regular customer earns somewhat of an average salary in Norway.

Customers would rather pay a lower price for a product than go to specialist stores and purchase what you can consider more high “quality” products. Therefore, they don’t shop for high-end brands for everyday products and look for a good “bang for your buck” deal.

The Business

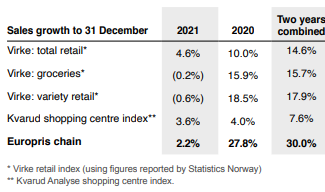

Europris has reached a large and mature scale, and expected growth is slightly higher than the market growth. However, Europris has consistently beaten the market in terms of sales growth. With the scale Europris sits at today, they have reached solid profitability and a strong cash flow.

Roughly 45% of the products Europris sells are sourced from Asia, and the rest comes from Norway and Europe. Europris has opened a sourcing office in Shanghai to secure a solid supply chain cooperating with Finish discount retailer Tokmanni. To achieve reasonable prices from their suppliers, Europris have a joint purchasing agreement with Tokmanni and ÖoB (Swedish discount retailer).

With Europris’s current and future sales volume, Europris is currently moving its operation to a large-scale warehouse at Moss. The new warehouse is set up to handle the increased volume growth the company expects. The warehouse will be fully operational in the first quarter of 2024.

At the end of 2021, Europris’s membership club “Mer” reached 1 million members. The “Mer” membership club is an essential asset to the business as it keeps customer retention high with weekly tailor-made deals on products. In addition, Europris also collect a large amount of data on customer behavior through the club.

Strategy

Europris has positioned itself as a low-cost retailer offering a wide variety of products. The store’s location is primarily in rural areas and the outskirts of the cities. In 2019, Europris started a new concept store called “Europris City,” a scaled-down store with a smaller offering of products in the major cities.

Europris's position in the retail market in Norway is unique. Europris is competing with almost all of retail, yet they have no large direct competitor that has the same offering as them. Stores like Normal, Jula, and Biltema are some of the companies that have alot of the same offering as Europris but none of them offer the excatly the same product categories.

At Europris, customers can find products categories like personal care, groceries, clothes & shoes, house & garden, electronics, kitchen, interior, pet food & accessories, and hobby & office. In addition, Europris have steadily increased their share of private label products and introduced successful labels like Effekt.

Europris is mainly a physical retailer, and revenue from its e-commerce operation accounted for 1,7% in 2021. However, the e-commerce revenue grew fast and grew 71% in 2021, resulting in NOK 147million. These numbers do not account for the acquisition of Lekekassen and Lunehjem, who both are purely online stores. Even with the increased focus on e-commerce, Europris has a pipeline of 10 new stores for 2022 and beyond.

Management & Ownership

Espen Eldal is the CEO of Europris and has been it since April 2020. Previously, Eldal was the company’s CFO (2014-2020) but was promoted to CEO when the former CEO Pål Wibe left to join XXL. Eldal’s education is in finance and administration; he is a certified auditor and has completed officer training school in the Norwegian military. Eldal currently owns 600 000 shares, 0,37% of the outstanding shares.

The management team consists of eight positions. The board of directors consists of seven members, where six out of seven directors own shares in the company. Currently, the board has a combined total number of shares at 1 356 547, which is 0,85% of the outstanding shares.

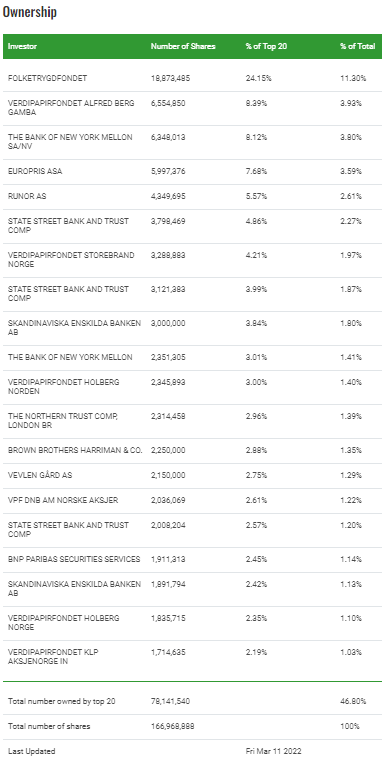

Europris due lacks a significant owner of the company. The largest owner is Folketrygdefondet, which is a governmentally controlled pension fund.

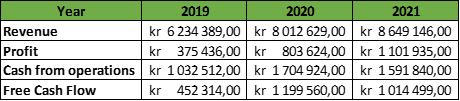

Financials

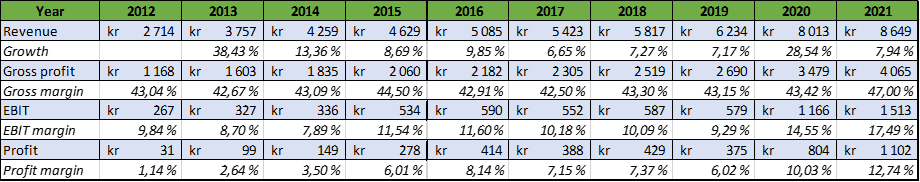

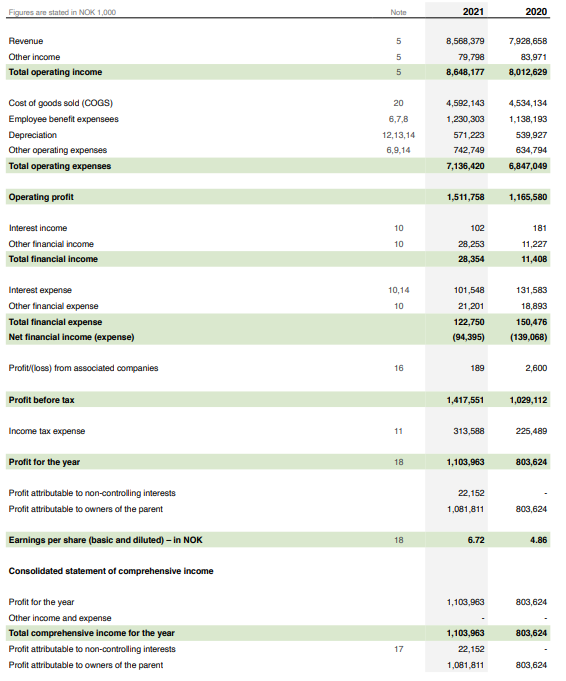

Revenue growth has shown to be stable and is expected to be at 7-10% onwards, including the acquisitions made in 2021. The gross margin has historically had very low variance but may take a hit in 2022 due to higher freight costs. Europris estimates higher shipping costs of NOK170-200 million. However, gross margins rose sharply in 2020 and 2021, mainly due to a fixed-rate agreement on inbound freight and increased demand due to the Covid pandemic.

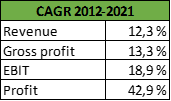

Before the Covid pandemic (2012-2019), Europris’s revenue increased 2,3x and profit 12x. From 2012 to 2021, revenue, gross profit, EBIT, and profit compounded at an annual growth rate of:

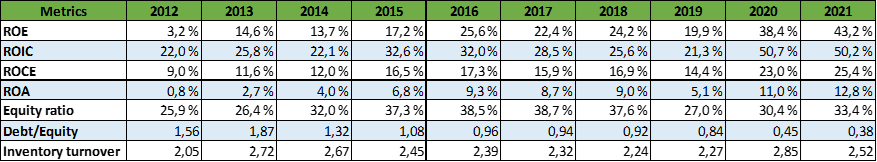

As for the returns on equity, capital and assets have been stable and slightly increasing each year. However, the returns rose sharply in 2020 and 2021 due to the Covid pandemic.

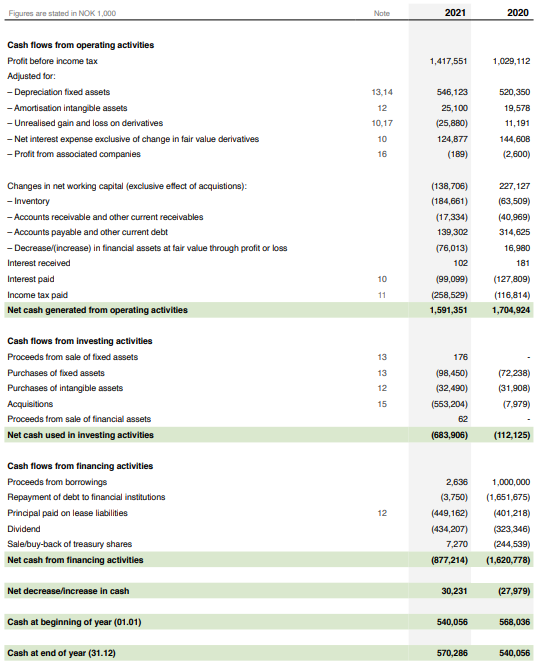

Cash-flow statement:

With high inventory turnover Europris does not need massive amounts of working capital to fund the business. Europris typically stock up on seasonal products during Q1, which it sells during the summer months.

There is no high demand for capital expenditure as the business does not require considerable tangible assets to operate. Instead, Europris is more reliant on leasing costs.

Income Statement:

The most significant expenses for Europris are the cost of goods and employee benefits and account for 65-70% of the revenue. Depreciation mainly consists of leasing liabilities. The tax rate is at 22%. Other operation expenses are transportation/distribution costs, marketing, and some leasing and other premises costs.

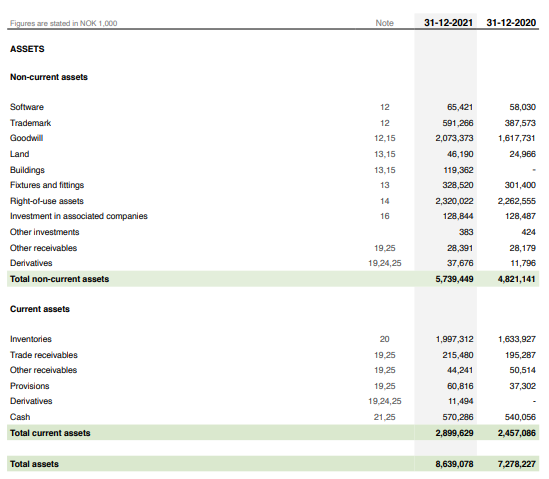

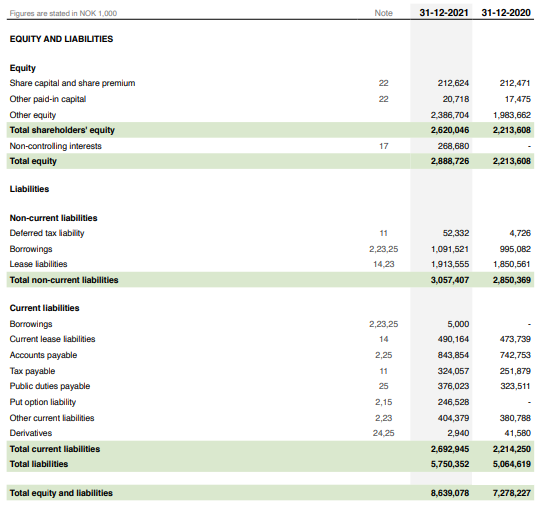

Balance Sheet:

Europris has a strong balance sheet. They have a moderate amount of debt and had in Q4 2021 net debt of NOK 525 million after adjusting for IFRS 16 (leasing liabilities). With an EBIT of NOK 1 512 808, they have no problem covering the debt.

Europris have also a lot of cash and liquidity available for the use of operations and acquisitions. At the end of 2021, the total available liquidity stood at NOK 1,956 billion, whereas NOK 571 million was cash and NOK 1 400 billion is in credit facilities.

Capital Allocation

Europris is a highly profitable business and produces a lot of cash, as you can see in the picture below.

With the free cash, Europris produces, they will mainly use it for dividends, buy-backs, and acquisition. Since Europris has reached a mature state and scale, the need for capital to be reinvested is not high. Therefore, Europris aims at paying out 50-60% of the profit in dividends and have paid out the following since 2016.

In 2020 Europris executed a buy-back of its shares of NOK 244,5 million, and the average cost was NOK 44,47. Europris currently holds 5,997,376 treasury shares. The purpose of the treasury shares is to be deleted, sold to employees, or used for future acquisitions.

Europris will probably reallocate future free cash after shareholder returns and reinvestment for acquisitions as they have done with Lekekassen and Lunehjem. Europris does not have a pipeline for acquisitions but monitors the market for possible opportunities. Therefore, you should not expect that Europris will acquire businesses regularly.

Acquisitions

In June 2021, Europris announced that they were acquiring 67% of Norway’s largest online store for toys for NOK 501 million. The founder and CEO, Andreas Skalleberg, will keep the remaining 33% of the shares. The acquisition was settled in cash. Europris has a pre-emptive right to acquire the remaining shares.

In Europris Q4 report, they announced revenue of NOK 591 million and EBITDA of NOK 110 million for Lekekassen. Lekekassen entered the Swedish market in 2019 and the Danish market in Q42021.

Europris also acquired a 67% stake in the home & interior online store Lunehjem. Sales for Lunehjem ended in NOK 32 million in 2021 and an EBITDA of NOK 4,4 million.

In 2018 Europris entered into a partnership with its Swedish counterpart ÖoB. As part of the partnership, Europris acquired 20% of the shares of ÖoB in 2019. And has the option of obtaining the remaining 80% of the shares. Europris has hinted that they want to exercise the option and acquire the entire company as they see a lot of synergies and benefits under å joint ownership. The purchasing price for ÖoB is 7,7 multiple of the average EBIDTA for the 2019 and 2020 financials. However, there is a dispute between the parties on the financial numbers. Therefore, an external accountant is hired to conclude the correct numbers. After the parties have agreed on the 2019 EBITDA number Europris has a six-month period to exercise the option to acquire ÖoB.

Investment Case

Key risks

Being a retail company means that competition is fierce. Europris faces competition from many players ranging from grocery chains, sports stores, pet stores, other discount stores, and newer online retail players.

The shift to e-commerce may benefit Europris negatively as they still are heavily dependent on physical stores. They are increasing focus on e-commerce and becoming a pure omnichannel retailer. With Lekekassen and Lunehjem, e-commerce sales accounted for 6,6% of the total sales in 2021. Customers who purchase online prefer to use the click and collect option rather than home delivery. Click and collect stood at 85% of the e-commerce sales for the Europris chain. Resulting in Europris increasing investment and focusing on the click-and-collect option.

The aftermath of the pandemic has resulted in massive pressure on the global supply chain. As a result, costs have increased in some instances five folds. Europris expects that the freight costs will increase NOK 170-200 million in 2022 due to bottlenecks in the global supply chain. And with the current war in Ukraine and huge volatility in commodity prices and shipping costs, product costs will be under pressure.

Global inflation will impact have an impact on Europris, to what extent is currently unknown. Being a discount variety retailer, having low prices is an integral part of the business. Moreover, the products are usually quite generic and can be bought in most retail stores. Therefore, Europris possess no pricing power and can not increase the prices to offset the inflation.

The acquisition of ÖoB is looking more likely to be a risky play. ÖoB has struggled with low or negative growth and low margins. If Europris acquires the company and does not execute on turning around the business, the acquisition will most likely result in value destruction.

Since the pandemic has ended, all restrictions have been lifted in Norway. The border to Sweden is no longer closed. Customers living in eastern Norway often travel to Sweden as Sweden offers lower prices on goods and alcohol. This can result in customers opting to shop in Sweden rather than at Europris. However, Europris has strengthened its positions in Norway during the pandemic and increased its customer loyalty.

Competitive advantages

Europris is the market leader in its niche, discount variety, in Norway. The stores are strategically located in more rural areas, where malls or other retail stores are not found. Customers think highly of the business and know exactly that they will find the products they need for daily life at a low price. Europris reported in the annual report of 2020 that they sit at 100% brand recognition in Norway.

The fact that Europris has no close direct competitor at their scale is a competitive advantage. The customer who doesn’t live in the cities and wants a vast, diverse product assortment for a low price has to shop at Europris. Otherwise, the customer would have to travel to several retail stores.

With the scale, Europris now has its bargaining power with suppliers, which lowers costs, increases margins, and makes it possible to have low prices.

Valuation:

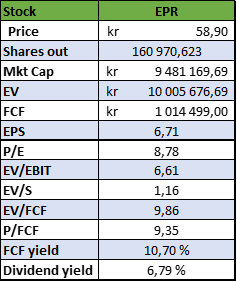

As of 26 March 2022, the stock price is NOK 58,90, which equates to a market capitalization of NOK 9,481billion. P/E is only at 8,78, and EV/FCF is 9,86. On these two metrics alone, Europris seems to be valued at the cheaper end of the scale. However, it shall be noted that Europris has had two great years due to covid. Should profit and cash flow normalize, Europris’s valuation would not be as attractive today. The valuation would then seem to be more reasonably priced.

If Europris continues to deliver results as they have in 2020 and 2021, you can expect a solid free cash flow yield. It is standing at 10,70 % of the time of this writing. So if Europris can continue to deliver the FCF they are doing today with some growth, they should offer an attractive investment opportunity. Both in multiple expansion and shareholder return. Should the stock price remain at the current level, it would be an attractive price for Europris to initiate a buy-back of shares.

The dividend yield is fairly high at 6,79%. However, adjusting for the additional dividend of NOK 1,5 the dividend yield for the normal dividend is at 4,2%.

Disclaimer: All investment strategies and investments involve the risk of loss. Nothing contained in this article should be construed as investment advice. Any reference to an investment’s past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit. Do your own research.

As of the time of the writing of this article, the author has a long position in Europris.